This post was originally published on this site.

Some of the best investments are in businesses that operate in relatively unknown but essential markets, working in the background and fulfilling functions that other companies either don’t want to, or can’t afford to do themselves.

One such business is Restore (LSE: RST), the leading provider of physical and digital document-management services in the UK. It stores documents for public- and private-sector organisations, such as the NHS, and destroys old documents. There’s also a document-processing business (called Synertec), which helps companies send electronic and physical communications and a technology division (Restore Technology). All of these help the company’s customers manage their data, whether it’s on paper or in digital form.

Restore is beating expectations

In 2024, Restore generated £275 /million in revenue. The largest proportion of revenue (£170 million) came from the information management division, the one responsible for storing and managing documents. Despite the global shift over the past 20 years away from physical to digital documents, there’s still a vast and steady market for this kind of storage and Restore, as the largest operator in this area, has the economies of scale required to make it work.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The City has raised questions about the sustainability of this business multiple times over the past few decades, yet despite these concerns, the firm has consistently outperformed expectations. It’s helped that Restore has been able to move into new markets, such as operating a “digital mailroom”, which scans and digitises inbound and outbound mail for clients. It also manages exam papers and physical document processes within government agencies.

The second-largest division is a business called “DataShred”. This does exactly what it says on the tin. It’s the largest document-shredding operation in the UK, servicing tens of thousands of companies every year. The third and fourth key divisions are Harrow Green, which helps companies move office, and the technology business. Restore has found that companies moving offices need to digitise and destroy physical records, although they often choose to store old records as well. Despite this, the company agreed this week to sell Harrow Green for £5.5 million in cash to focus on the core business.

Restore’s exciting potential

The technology business helps clients manage their tech assets, such as laptops and desktop computers, to ensure security throughout the asset’s life cycle. Some of its biggest clients here are public bodies, such as the Department for Work and Pensions. Restore helps the department set up new laptops, test laptops in use, and erase as well as repurpose laptops when they come to the end of their life. It can process thousands of laptops a day and has a two-week turnaround window to get each computer back into the workforce. Laptops that are not going to be repurposed for new joiners can be securely and responsibly disposed of.

This division currently accounts for just 11% of group revenue, but it has vast potential. Management has highlighted the AI product cycle, the release of Windows 11 and the beginning of the post-Covid technology refresh cycle as structural drivers for growth. The current best practice is for companies to refresh technology every three to five years. Overall, the firm has 500 active customers at present, served by 310 employees, with the capacity to refresh 13,000 assets a week.

The technology business has exciting potential over the coming years, but investors shouldn’t overlook the document side of the organisation. To bulk out this division, in March, Restore paid £33 million to acquire Synertec, which owns a proprietary software platform that helps clients communicate with their customers across different channels. Using the software, clients can upload customers’ communications to Synertec’s systems and select how they want the information to be distributed.

This can include documents printed in braille, for example, or communications sent out via text message. Synertec can turn around the client’s data request overnight, a key selling point for its largest client, the NHS, with which it recently agreed a new four-year framework set to start in the first quarter of next year. Synertec also works with clients such as P&O Ferries, Screwfix and Hotpoint.

A new direction for Restore

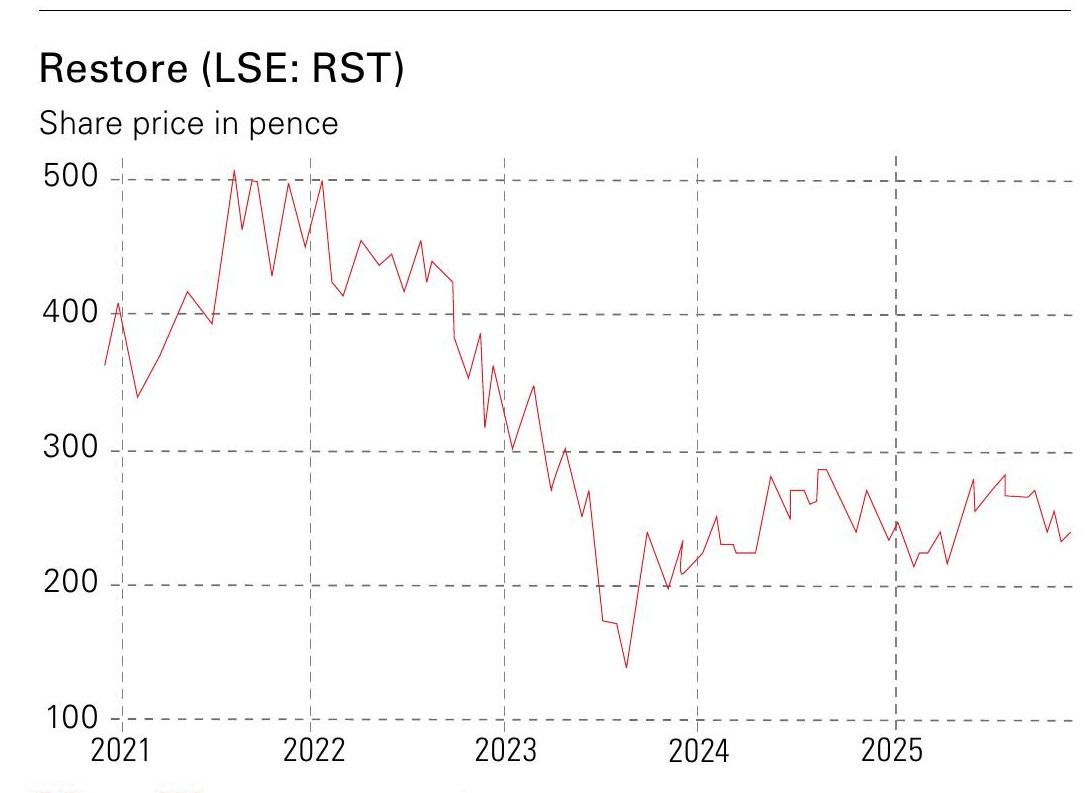

Despite its strengths, shares in Restore have declined by around 50% since the pandemic, even as adjusted profit before tax has risen from £23.2 million in 2020 to £34.4 million in 2024. Lack of confidence in the company’s strategy, multiple compression and general apathy among investors towards UK small caps all appear to be to blame.

However, after a change of management two years ago, the City is starting to come around to the growth story. Charles Skinner returned as CEO in 2023, after Charles Bligh, who joined as CEO in 2019, resigned. Skinner stepped down in 2019 following a decade at the helm of the group, during which time the shares returned more than 2,200%. Skinner has spent the past two years refreshing the group and its strategy, but the market is yet to factor in the changes.

According to analysts at Berenberg, the shares are trading one standard deviation below the 10-year average price-earnings (p/e) ratio of around 15; the same is true on an enterprise value to Ebitda basis. Berenberg has the stock trading at a 2026 p/e of 9.9 and a free cash flow yield of 8.3%.

Canaccord Genuity takes a similar view, with a p/e of 10 pencilled in for 2026 and a free cash-flow yield of 8.3%. What’s more, in its latest trading update, Restore reported growth ahead of market expectations, with margins returning above the medium-term 20% target, prompting a wave of analyst growth upgrades. This growth, coupled with a return to the company’s 10-year average valuation, could generate an upside of nearly 70% for the shares in the best-case scenario.

(Image credit: LSE)

This article was first published in MoneyWeek’s magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

![[Aggregator] Downloaded image for imported item #272304](https://sme-insights.co.uk/wp-content/uploads/2025/12/Jyk6rYyJTvVtMUhrBZtUpR-1280-80-1068x709.jpg)