This post was originally published on this site.

Private credit is not the catchiest topic. Put it alongside AI or bitcoin, and you can see why it doesn’t make so many headlines. Yet there has been a growing stream of stories over the past year or so about the potential risks that could be lurking in the sector, to the point where big names such as Marc Rowan of Apollo apparently feel the need to step up and defend it.

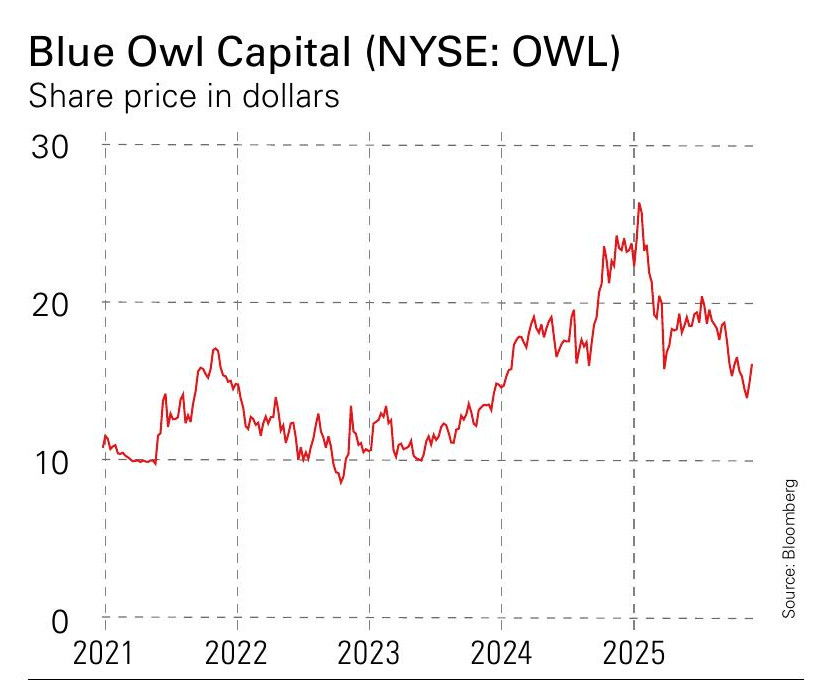

Shares in Blue Owl Capital, which is exposed to some of the main worries that investors have about private credit, have fallen about 30% this year. It has done noticeably worse than private-markets peers such as Apollo or Ares, which are big players in private credit, but have a smaller proportion of their overall business there.

(Image credit: Bloomberg)

These jitters may be pretty much irrelevant unless you are investing in private credit. I am a little sceptical about it as an investment, but that doesn’t mean that losses will have much impact on other markets. If private credit has indeed taken lending off bank balance sheets – as supporters claim – it could even reduce the consequences of higher defaults.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Private credit’s link to the AI boom

Still, investors who remember the global financial crisis will recall the structured finance boom – mortgage-backed securities (MBSs), collateralised debt obligations (CDOs) and an alphabet soup of other vehicles. These were also supposed to redistribute risks and make the system safer. They ended up doing the opposite. That does not mean that private credit is likely to do the same – there are very significant differences between direct lending and structured finance. It only means that investors should be alert to unexpected consequences.

One of the intriguing aspects of private credit is the growing link to the AI boom. Data centres cost a great deal of money and private credit seems to be funding more of it: UBS estimated in August that private credit to the tech sector had risen by $100 billion (or 29%) in 12 months.

For example, Meta Platforms is building a $27 billion data centre in Louisiana, financed by Blue Owl’s funds. The accounting in this deal is intriguing: the liability is mostly off Meta’s balance sheet on the basis that the tech giant only enters into a four-year contract, renewable every four years – even though it provides a “residual value guarantee” to protect bondholders if it doesn’t renew. Still, Meta is probably good for the money. Some of the other data-centre firms will not be if their customers walk away.

Does this mean that an AI bust would ripple through credit markets, spreading the pain more than expected? Who knows. That’s the problem with private markets. It’s hard to see where the risks lie and who might be left holding the bag.

MoneyWeek has launched a new weekly email newsletter called Investing Spotlight. Dan McEvoy – who has written here on AI and other topics in recent months – will discuss the latest news and trends in investing. Sign up to the MoneyWeek newsletter to get it every Friday evening.

This article was first published in MoneyWeek’s magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Explore More

![[Aggregator] Downloaded image for imported item #260233](https://sme-insights.co.uk/wp-content/uploads/2025/12/b7F8q9HnVTZ9oBhHGCmAyS-1280-80-1068x599.jpg)