This post was originally published on this site.

If nothing goes awry between now and the new year, 2025 will end up being a much better year for stocks than looked likely eight months ago. The US tariff sell-off in early April was severe at the time, but the slide ended faster than expected and markets rebounded quickly.

For all Donald Trump’s bluster, the reality is that he backtracked on the level of tariffs pretty significantly. Foreign governments signed a bunch of deals to placate him, including many promises around investment and trade that they will do their best not to deliver. Central banks began loosening monetary policy a bit more. So stocks went up again: the MSCI ACWI index – which includes developed and emerging markets – have returned a very strong 18% (including net dividends) in local currency terms.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A long-term view on US stocks

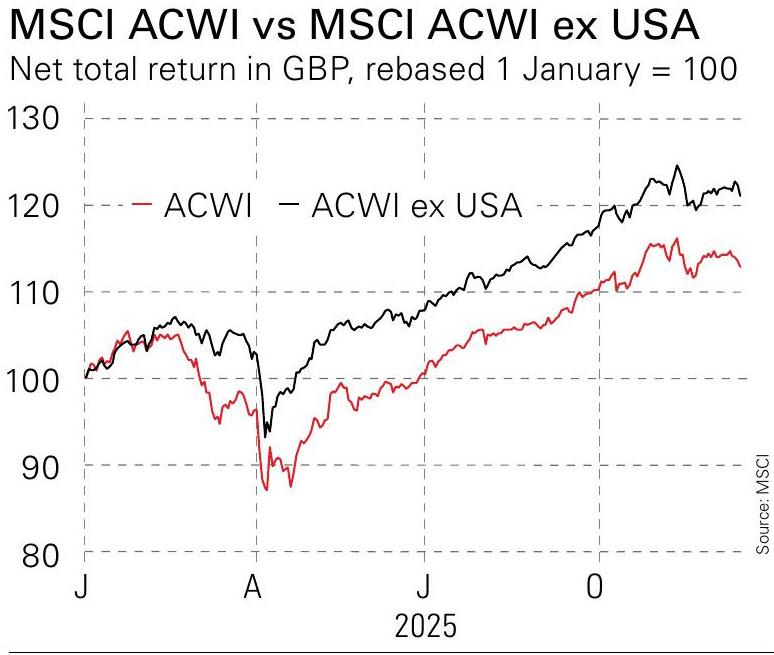

Yet something is different. US stocks have returned around 16% this year – an above-average performance. However, that is only just in line with Europe and well below many European countries (including the UK), Japan and emerging markets. Note too this is in local-currency terms: factor in the drop in the US dollar and investors have done better in almost any other market. This runs against American outperformance in recent years and is the opposite of what most strategists were expecting at the start of 2025.

(Image credit: MSCI)

We cannot know whether this will happen again next year. However, on a long-term view we can note that the MSCI USA index trades on a forecast earnings yield (earnings divided by price) of around 4.5%. The MSCI Europe index is on an earnings yield of over 6.5%, the MSCI Japan is around 6% and the MSCI Emerging Markets is a bit under 7.5%.

In theory, the earnings yield is a direct proxy for expected longer-term real returns. You either get earnings back as dividends or reinvested by companies to create growth – either way, a higher yield should mean stronger returns. Reality is never that simple, but it is unarguable that the US will have to keep delivering much better earnings growth than the rest of the world to overcome the drag of starting on a lower yield.

So on a longer-term view, the odds are in favour of an extended spell when the rest of the world outperforms. This is why our asset allocation portfolio – which I will be reviewing shortly – keeps significantly underweighting the US despite its strong past performance. That call may finally be starting to work in our favour.

This article was first published in MoneyWeek’s magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

![[Aggregator] Downloaded image for imported item #368253](https://sme-insights.co.uk/wp-content/uploads/2025/12/oZesgPgqn4oqzd8spRdkui-1280-80-1068x657.jpg)