This post was originally published on this site.

Annual house price growth dipped in November but the market remained resilient despite threats of increased taxation in the Autumn Budget, new figures show.

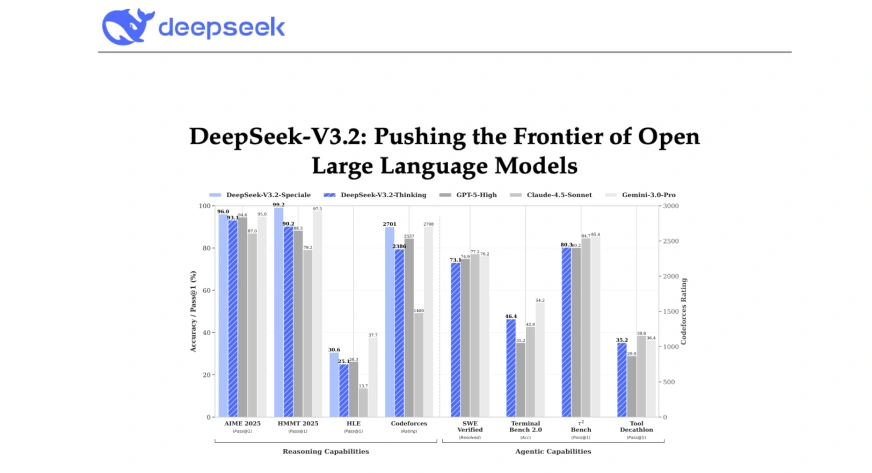

House prices are up 1.8% in the year to November, according to Nationwide’s House Price Index, down 0.6 percentage points from October’s annual price growth figure of 2.4%.

The slower rate of annual growth meant the price of a typical house increased by 0.3% between October and November, bringing the average price of a UK house to £272,998 – a month on month rise of £772.

Sign up to Money Morning

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don’t miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

(Image credit: Nationwide)

Robert Gardner, chief economist at Nationwide, said: “The housing market has remained fairly stable in recent months, with house prices rising at a modest pace and the number of mortgages approved for house purchase maintained at similar levels to those prevailing before the pandemic.

“Against a backdrop of subdued consumer confidence and signs of weakening in the labour market, this performance indicates resilience, especially since mortgage rates are more than double the level they were before Covid struck and house prices are close to all-time highs.”

Did the Budget affect house prices?

In November, many homeowners and prospective buyers will have been anticipating a shake-up to how property is taxed in the Autumn Budget, which was delivered on 26 November.

In the weeks leading up to it, reports suggested the chancellor was going to hike property taxes, but most owners were spared. Just those with a home valued at £2 million or more face a new ‘mansion tax’.

These rumours had a strong effect on consumer sentiment, which took a hit before the Budget, but this does not seem to have translated into a palpable dip in the market.

Gardner at Nationwide believes the new ‘mansion tax’ is “unlikely to have a significant impact on the housing market” in the long term as the new levy will apply to less than 1% of properties in England and around 3% in London.

Gardner expects the increase to the rate of income tax on property income to have a more profound impact, as it may dampen the supply of new rental properties.

Alice Haine, personal finance analyst at Bestinvest, supports this view, calling the two percentage point tax hike a “sting in the tail” for landlords.

She added: “This could be the tipping point for some landlords, prompting sales after years of rising taxes and tighter regulation, while others may resort to passing increased costs on to tenants – pushing rents even higher.”

Where will house prices go next?

Following a Budget where the worst-case scenarios were avoided, Gardner at Nationwide believes the outlook for some buyers is set to improve.

He said: “Looking forward, housing affordability is likely to improve modestly if income growth continues to outpace house price growth as we expect. Borrowing costs are also likely to moderate a little further if Bank Rate is lowered again in the coming quarters.

“This should support buyer demand, especially since household balance sheets are strong. Indeed, in aggregate, the ratio of household debt to disposable income is at its lowest for two decades.”

Increased affordability in the market is also expected by Haine at Bestinvest, who said market confidence could return after this Autumn’s pre-Budget dip, as buyer demand and the number of listings could increase.

She said: “While property tax changes may dampen demand at the upper end of the market, and higher taxation could accelerate buy-to-let exits, there could be a resurgence in wider market activity. Buyers who paused moving plans in the run-up to the Budget, in a bid to assess the impact of any new measures, may now make a return.”

Explore More

![[Aggregator] Downloaded image for imported item #127439](https://sme-insights.co.uk/wp-content/uploads/2025/12/RxMdkvFEUbg7zHcwpAp4BP-1280-80-1068x711.jpg)